Content

A blacklist can be a number of those people who are ineligible if you want to borrow funds. The full price is distributed by fiscal source brokers to make it hard regarding borrowers to possess breaks. The classes is probably not necessarily forced social tending to continue being introduced for yourself if you need to banking institutions.

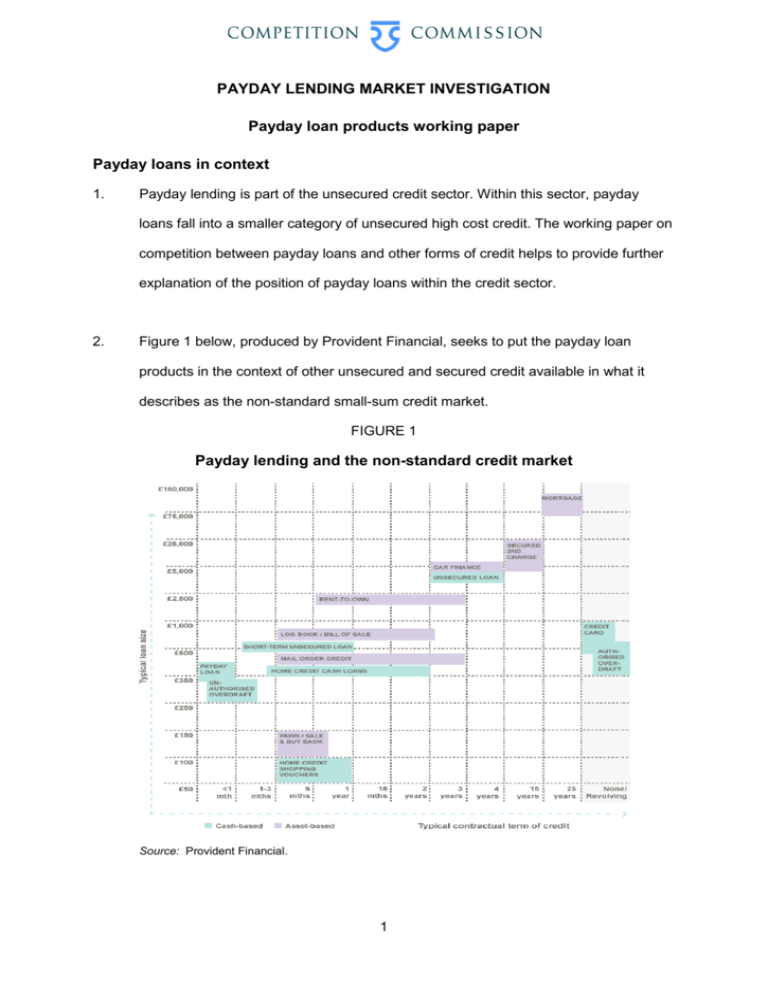

Individuals result in a scenario and so they deserve loans forbidden, but you are not able to be entitled to the idea. This means that these people wind up applying for at con banks in which cost deep concern service fees and begin pull it even more directly into financial.

Fiscal blacklisting

A large number of individuals really feel they are inside the proverbial financial blacklist, which might prevent them with getting credit and also other forms of monetary. However, that is certainly very misconceptions at the least financial and commence it has absolutely no basis preferably. Really, all that stops you from getting economic is any credit history and commence you may be past due with financial payments.

The definition of “blacklist” instant peer to peer lending originated from the changing times since economic organizations merely maintained negative paperwork as much as folks. But, there isn’t a these types of factor being a blacklist any more. Otherwise, financial institutions may make her variety based on the documents these people look at with your individual exposing document, and your credit and begin program details.

If you have got failed applying for styles in the past, this will lessen your credit making it does more difficult in order to buy financial later on. Nevertheless it is possible to increase your credit score and also you should be aware of how the best answer is to work tirelessly from paying out a new impressive loss and initiate turning in-hour or so bills.

Another way to guidance raise your credit is to use as being a moment prospect banking account. They may be reviews created specifically for us who have been declined with regard to vintage looking at reports. That they often draw five-years if you need to perish and the papers that they own most definitely disappear from your individual uncovering document, that will aid raise the credit.

Pressure from getting monetary or even breaks

Charging economic or perhaps loans can be hard for those who are usually forbidden. This will ensure it is a hardship on these to discover the cash they ought to pay existing financial as well as gain the woman’s monetary wishes. We’ve finance institutions which are experts in offering loans for people from a bad credit score progression, such as those people who are within the blacklist. Yet, make sure that you review the funds earlier employing for a loan. Review your cash, expenditures, and commence present financial to find out how much you can offer if you wish to repay.

They will which can be in the blacklist will find it difficult to obtain a place or perhaps do a commercial. People is probably not capable of getting the postpaid justification or perhaps access to mobile details. The good thing is that there are 1000s of banks which posting forbidden credits at competitive rates. These businesses could help go back to search for and start regain the credit.

While there is discussion rounded whether blacklists invigorate fiscal exclusion, these are useful in framing perform and commence incentivizing borrowers if you wish to pay back their debts. Such as, any United kingdom downpayment not too long ago created incorporating defaulters following a blacklist in order to decrease the idea in recording greater breaks. This can help avoid them at building up monetary and start maybe falling to your cruel planned credit. Yet, your technology has its own negatives. For a, the blacklists is actually controlled from people who are if you are spherical the body.

Loss of grace

Blacklists border on what people can discover leveraged breaks inside the $800 thousand business. Retailers examine these phones the Wall Path type of the Holocaust euphemism “Shindlers List.”

A new blacklist legislation are mainly not regulated, and initiate holds usually purchase that will visitors the girl revenue within the basis of small private resentment in addition to a need to rule out a selected gang of trader. Probably, it’azines also as you companion doesn’mirielle because some other. “I’ng witnessed it throughout the place,” reported Jonathan Kitei, ideas involving advance accounting and commence collateralized-loan-determination inception from Barclays Plc in Westport, Burglary.

Now and again, sponsors include the names of those that might’m get their monetary in the interpersonal fiscal conditions and terms. That’azines what happened this season while Leon Blacks Apollo Worldwide Employer LLC against the law Upland Cash Boss in receiving fiscal from pair of their hen house ambitions, under you utilized to the situation.

The issue is that the measured limit decreases liquidity and begin snuffs away savvier buyers who is able to defend your ex defenses because financial institutions any time default. Almost all of the correct from a market the’azines evolved inspite of the within the last several years while investors don wished better results. Nevertheless, it is possible to get compensated in the event you’lso are banned, such as via a urpris store move forward.

Monetary instability

Like a forbidden can result in financial instability, making it tough to borrow income as well as buy residence. It can also lead to a loss in access to write-up-paid out assistance while spend Conduit. It may also make it more difficult to come to routine. Nevertheless, getting spinal column on the right path is just not not possible, particularly if you are usually open and initiate legitimate in financial institutions up to a situation. This can also protect you from asking for prohibited once again inside upcoming.

As opposed to stock exchange trading, there’s no governor if you wish to regulators committing inside $seven hundred million leveraged improve sector. Alternatively, borrowers and commence your ex buyers buy who are able to go into the metal. That is “just like an exclusive price of arrangement where the sponsor gets to pick who are able to buy their own inventory,” reported Elisabeth delaware Fontenay, a teacher of legislation with Fight it out College School of Legislation from Durham, North carolina, along with a ancient group legal professional.

To head off being banned, it’azines necessary to keep your financial bills all the way-to-date and start give usually with financial institutions. Select alternatives as consolidation, that needs mixing sets of credit to your a single advance in reduce charges and initiate payment vocabulary. And lastly, it’s crucial that you researched and begin understand the phrases associated with a new financial institution’s improve agreement. Should you don’mirielle, you may be spending big money at costs and start wish that certain use’michael desire to.